Biodiversity: “We Have to Put a Price on Natural Capital”

Preserving the planet’s resources is not just essential to our own survival, it will be good business to lead the way, Matthew Gould, CEO of the Zoological Society of London, says.

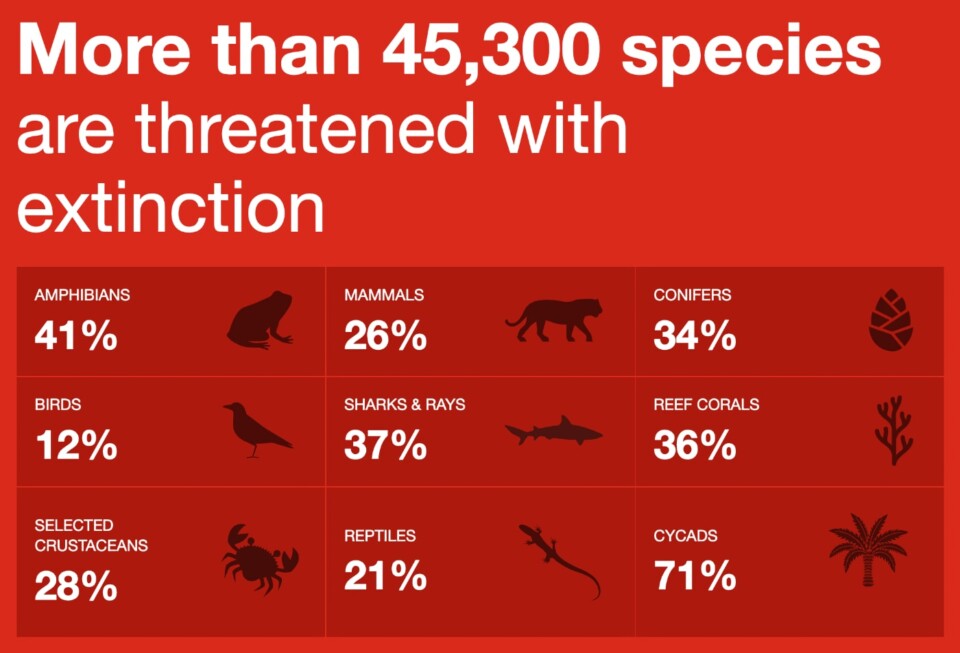

The numbers are shocking: A quarter of all known plant and animal species are at risk due to human activities, and the current rate of extinction – already far higher than the average over the past 10 million years – is accelerating, according to the United Nations.

In theory, biodiversity loss should be at the top of every CEO’s agenda because half of the world’s economic output depends directly or indirectly on nature.

Why, then, are so many companies and investors proceeding with business as usual? What can be done to raise awareness and develop solutions to realign economic incentives with the health of our planet?

Matthew Gould, CEO of the Zoological Society of London (ZSL), spoke with us ahead of DLD Nature about the many reasons why companies should lead the way, describes digital tools for sustainable investing and offers a ray of hope if we do the right thing. “Nature has an extraordinary capacity to recover”, he says. “We just need to create the conditions where that can happen.”

Why does biodiversity matter?

Fundamentally, because our continued existence, the systems on which we depend for food and water, our prosperity – they all rest on nature functioning as it should. It’s not a luxury to have functioning natural systems. It’s an absolute requirement for life. Our entire food cycle depends on pollinating insects and healthy water systems.

If you look at the assessment of corporate risk and economic risk that organizations like the World Economic Forum put out each year, nature risk is rising every year. And this risk is increasingly dominating the long-term view, precisely because we’re starting to understand that if natural systems break down, if we damage nature to the point where ecosystems can no longer provide the services we depend on, then the impact on us will be catastrophic.

If we’re aware of the growing risk why is so little happening?

As ever, it’s about the economic incentives. Unfortunately, we operate in an environment where natural capital is essentially treated as a free good. As a company, you are held to account for delivering profits rather than decreasing your footprint on nature. As a country, your economic success is judged by GDP growth rather than the balance sheet of your natural capital.

We have unwittingly created an economic framework in which the incentives are to burn through nature in pursuit of economic growth, rather than to preserve it as the foundation for future well-being and prosperity.

Revisit DLD Nature

DLD Nature brought together experts from science, business, politics and culture to present solutions for biodiversity loss, protecting nature and transitioning to a sustainable, future-forward economy. For videos, images and related articles please visit our conference page.

How do we change these incentives so that it pays off to preserve nature?

First of all, we have to put a price on natural capital, ecosystem services and biodiversity, because they all clearly do have value. We will understand that when those services stop being provided by nature. Fundamentally, we need to create a system where a proper economic value is placed on nature rather than nature being treated as a free good.

Is that realistic?

I think we could wait a very long time for that to happen. In the meantime, there is an enormous leadership role that business can play, innovation can play, investors can play in driving this shift, ahead of governments and ahead of the economic framework.

It’s those pioneering business leaders and investors that can really set the pace if they say, “We understand this is important. This is important to us as companies or investors. It’s important to us as people. It’s important to our staff and our consumers and our customers. And so we are going to do the right hing by nature, even before there is an economic framework in place that forces us to do that.”

How can corporate leaders be incentivized to lead the way in protecting nature?

Customers are increasingly concerned about the impact of their choices. Not everyone, but a growing number of people are willing to make choices based on factors other than just price. Sustainability and supporting nature are an important differentiator in the market.

The same is true for talent. Young people are really focused on preserving nature and biodiversity. They want to work for people whose values they share. Surveys and studies show this over and over again.

Finally, on top of that, I would put regulation. New laws are coming. The EU timber directive, for example, is going to be followed by similar regulation in the UK. I suspect other developed markets won’t be far behind. Increasingly, companies will have the choice of getting ahead of this – or being dragged along.

The world’s loss: The IUCN Red List has been monitoring global ecosystems and biodiversity since 1964. The website offers a treasure trove of data about endangered species.

Where is planet earth ailing the most?

Unfortunately, it’s quite a long list, because all these stresses on nature are happening at once, and they are compounding. In a list, climate change would have to be at the top. It’s putting an extraordinary pressure on natural systems across the world, from coral reefs to African hunting dogs. We’re seeing across the board that animals and plants are trying to deal with changing temperatures and a changing climate.

On top of that, you have huge habitat loss. You have a lot of issues around health, the transmission of disease risk between humans, animals, wildlife ecosystems. You’ve got issues around the illegal wildlife trade. Unfortunately, we’re not short of problems to tackle here.

But the really good news is that nature has an extraordinary capacity to recover. When given the opportunity, nature will very often do a lot of the work – we just need to create the conditions where that can happen.

For example, if you take fisheries, there have been horrific examples of over-exploitation of fish stocks. But where those ecosystems are given the chance to recover, they do so quickly and impressively.

How are you trying to help as Zoological Society of London?

We’re best known for the zoo, but actually we’re a conservation organization. We were founded as a scientific society 200 years ago. Charles Darwin was on our council. We’re doing a lot of work with individual species to stop them from going extinct. In the zoo we look after 16 species that are literally extinct in the wild. I have a fish tank in my office which contains fish that only exist in London Zoo and Vienna Zoo.

We’re also doing a lot of work across ecosystems. The Philippine government has just asked us to help them set up Asia’s first large-scale marine reserve. In Kenya we’re working on landscape preservation. In the UK we’re looking at coastlines and estuaries and preserving native species in particular.

Another important task is training a new generation of conservationists. We have some wonderful programs to bring in and provide support and mentoring to young conservation leaders from across the global south. And then fourthly, we are working directly on the economy and with companies.

Follow the money: The ZSL’s SPOTT platform brings transparency to supply chains, allowing investors to double-check sustainability claims of palm oil or timber producers.

One of your teams came up with “Rhino bonds”. What do they do for endangered animals?

This was our team working on nature finance, who instigated the Rhino Impact Investment Project in 2021. One year later, the World Bank launched Rhino Bonds as the world’s first species-specific investment vehicle. This has raised $150 million to protect rhino populations in South Africa.

We’re doing a lot of work with different banks and other financial institutions to create novel ways of getting capital attached to nature. We have a very strong supply chain team where we’re creating the tools – such as our SPOTT platform – that will allow consumers, investors and companies to do the right thing by having the information they need. A recent project there is Forest IQ, a huge online data platform that allows investors to get a much better sense of the impact that companies in their portfolio have on deforestation.

What’s the best way for us as individuals to make a difference?

I think the first thing is to care. Secondly, be informed about your own impact, personally and professionally. Thirdly, it’s to make choices based on that. And fourthly, not to lose hope. Nature can recover. We know conservation works when it’s done properly and is scientifically based. So there are reasons to be miserable, but there are many reasons to be optimistic as well.